25.03.2019, 6746 Zeichen

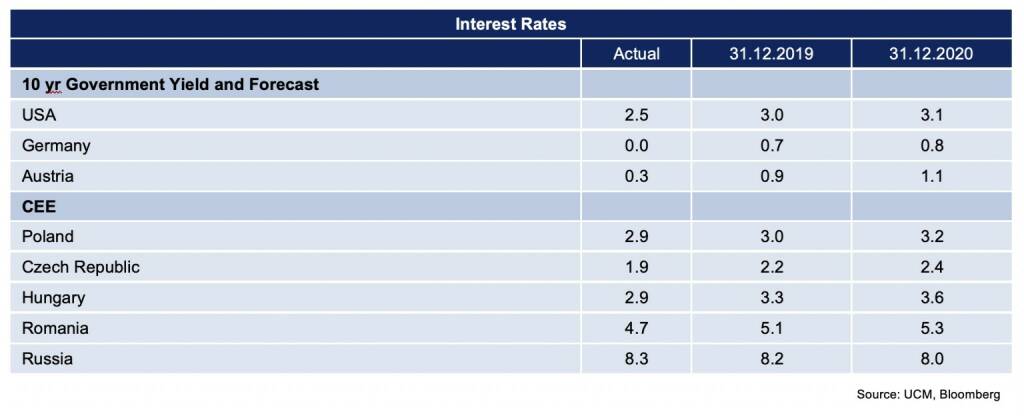

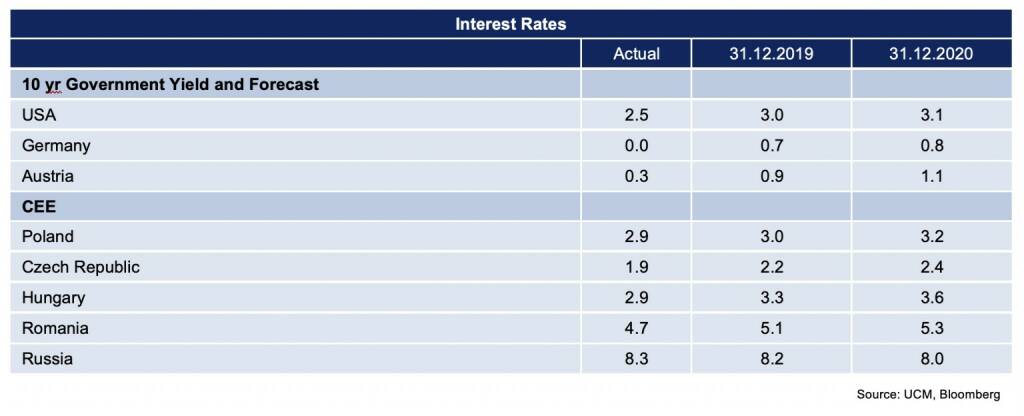

- US Fed refrains from raising interest rates in 2019 due to slowing business cycle momentum.

- Balance sheet normalization ends in September and the pace of normalization is slowing from May onwards.

Last week the Federal Open Market Committee (FOMC) of the US central bank (Fed) has confirmed a more cautious approach towards monetary policy in 2019. New economic projections of FOMC members, which are released at a quarterly frequency, do not indicate any further changes in the federal funds rate in 2019. After four interest rate increases in 2018, the upper bound of the federal funds target rate stands at 2.5 %. With signs of the US economic expansion losing steam and the level of the federal funds rate within estimates of its longer-run neutral level, the Fed sees no need to further tighten monetary policy. At the same time, the FOMC adjusts the pace of balance sheet normalization. Monthly redemptions of Treasury securities which are held within the Fed’s System Open Market Account (SOMA) will be capped at 15 bn USD from May onwards, currently being capped at 30 bn USD. Moreover, principal payments will be fully reinvested from October 2019 onwards such that the size of the SOMA portfolio will remain close to 3,500 bn USD. Overall, both measures confirm the Fed’s shift to a more cautious data-dependent wait-and-see approach, which has already been heralded in January.

In December, FOMC members still expected the federal funds rate to be increased two times in 2019. The most recent economic projections of FOMC members from last week indicate the federal funds rate to remain constant for the whole year. Why the change in course? Since last December, uncertainty regarding the strength of the US business cycle has intensified. The US economy has experienced strong growth in 2018, at 2.9 %, yet already available indicators for the first quarter of 2019 point towards weaker growth momentum. The Federal Reserve Bank of New York, for instance, predicts annualized quarter-on-quarter GDP growth (q/q, saar) at 1.3 % for Q1 2019 and 1.7 % for Q2 2019 [1]. Assuming this pace to endure for the whole year (average over Q1 and Q2), would yield an annual GDP growth rate of 2.1 % for 2019. This is about half the growth momentum of 2018. The FOMC members’ economic projections show GDP growth at 2.1 % for 2019, indicating their expectation of slowing growth momentum. Nevertheless, compared to the December projections, GDP growth in 2019 has only been adjusted moderately from 2.3 %. No significant downward adjustments of economic growth combined with a lower expected federal funds rate path is well in line with our last week’s UNIQA Capital Markets Weekly [2].

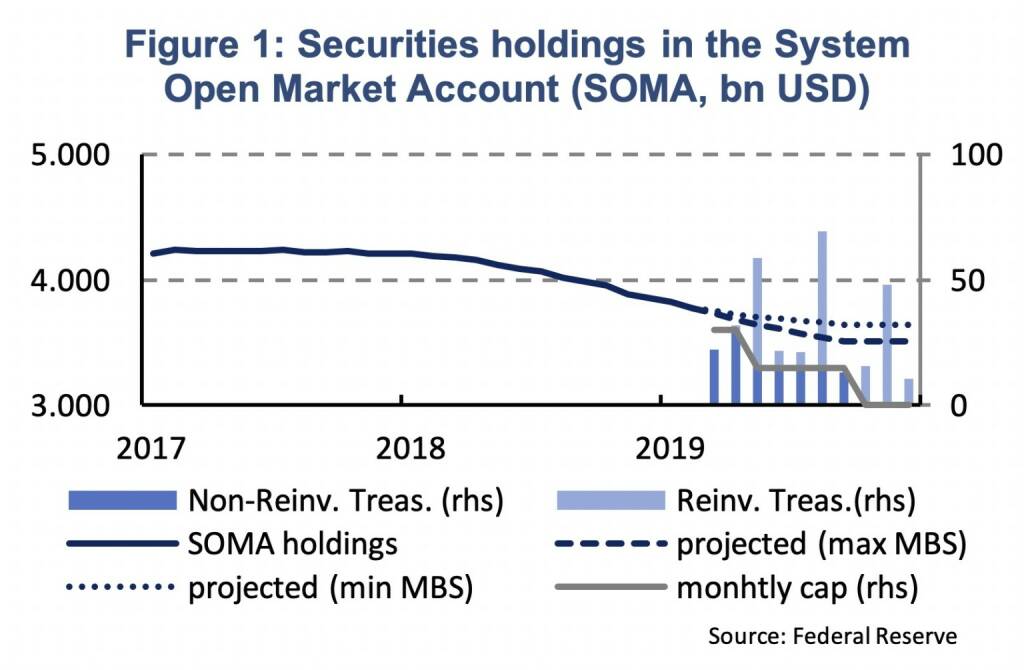

Last week’s FOMC meeting has further brought an update on the Fed’s balance sheet normalization. Since October 2017, the Fed has continuously reduced its balance sheet by reducing reinvestment of principal payments it receives from securities held in the System Open Market Account (SOMA). Since then, the SOMA portfolio has declined by 468 bn USD to reach 3,756 bn USD as of March 20th, 2019. So far, monthly redemptions have been capped by 30 bn USD in the case of Treasury securities and 20 bn USD in the case of agency debt and mortgage-backed securities (MBS). In May 2019, however, the cap on monthly redemptions of Treasury securities will be reduced to 15 bn USD, slowing the pace of balance sheet normalization. Moreover, from October 2019 onwards, principal payments will again be fully reinvested, thus, holding the SOMA portfolio constant. Applying the monthly caps to the specific maturity profile of the SOMA portfolio yields a final portfolio of 3,506 bn USD by the end of September 2019 (Figure 1) [3].

Once the SOMA portfolio has reached its new constant level in October 2019, its composition will, nevertheless, change. That’s because the Fed intends to reinvest redemptions from agency debt and MBS into Treasury securities up to a monthly cap at 20 bn USD. At the moment, agency debt and MBS account for 1,602 bn USD, or 43 % of the SOMA portfolio. Hence, from October 2019 onwards the Fed will extend its holdings of Treasury securities by up to 20 bn USD per month. By the end of 2020, the share of Treasury securities within the SOMA portfolio might, therefore, increase to 67 % or 10 %-age points above today’s share.

Thus, the Fed intends to reduce its balance sheet until September 2019 after which the SOMA portfolio might remain constant for some time. The SOMA portfolio’s level at which it will remain constant, roughly 3,500 bn USD, will nevertheless change its composition as the share of Treasury securities rises. It should further be emphasized that, in spite of, a constant SOMA portfolio, reserve balances will gradually decline. As non-depository liabilities on the Fed’s balance sheet are gradually increasing, mainly federal fund notes (currency), deposits need to go down, at constant asset holdings. Once, the level of reserves has been reached, which is consistent with efficient and effective implementation of monetary policy, the Federal Reserve will again increase its securities holding to keep pace with trend growth of non-reserve liabilities [4]. The adequate level of reserve balances remains uncertain. In a recent speech Fed Chair Jerome Powell indicated estimates around 5.6 % of GDP to be the new normal with total liabilities at 16.5 % of GDP [5]. In nominal terms the latter would roughly correspond to 3,500 bn USD for the total balance sheet, based on nominal GDP in 2019, thus, not too far apart from end-of-year estimates [6]. It should not be too long before the Federal Reserve balance sheet has reached its new normal.

[1] New York Fed Staff Nowcast from March 22, 2019 (https://www.newyorkfed.org/research/policy/nowcast).

[2] UNIQA Capital Markets Weekly as of 19thMarch (http://press-uniqagroup.com/news-uniqa-capital-markets-weekly?id=81187&menueid=1684).

[3] This assumes that early redemptions of MBS are sufficient such that the monthly cap of 20 bn USD becomes binding. If there are no early redemptions of MBS, which is unlikely, the SOMA portfolio will normalize at 3,645 bn USD. The latter yields the highest possible level of the SOMA portfolio.

[4] Reserves are funds that depository institutions hold on deposits at the Federal Reserve.

[5] Jerome H. Powell, Monetary Policy. Normalization and the Road Ahead, Speech at the 2019 SIEPR Economic Summit, Stanford Institute of Economic Policy Research, Stanford, California (https://www.federalreserve.gov/newsevents/speech/files/powell20190308a.pdf).

[6] Total assets are currently about 200 bn USD larger than the SOMA portfolio.

Authors

Martin Ertl Franz Xaver Zobl

Chief Economist Economist

UNIQA Capital Markets GmbH UNIQA Capital Markets GmbH

Börsenradio Live-Blick, Di. 23.4.24: DAX fester und zeitweise über 18000, SAP noch fester, VW/Mercedes/BMW in China

Bildnachweis

1.

Securities holdings in the System Open Market Account

2.

Interest Rates

Aktien auf dem Radar:Addiko Bank, Immofinanz, Palfinger, Flughafen Wien, S Immo, Frequentis, EVN, Erste Group, Mayr-Melnhof, Pierer Mobility, UBM, AT&S, Cleen Energy, Lenzing, Rosenbauer, RWT AG, Warimpex, Oberbank AG Stamm, SW Umwelttechnik, Athos Immobilien, Kapsch TrafficCom, Agrana, Amag, CA Immo, OMV, Österreichische Post, Strabag, Telekom Austria, Uniqa, VIG, Wienerberger.

Random Partner

Baader Bank

Die Baader Bank ist eine der führenden familiengeführten Investmentbanken im deutschsprachigen Raum. Die beiden Säulen des Baader Bank Geschäftsmodells sind Market Making und Investment Banking. Als Spezialist an den Börsenplätzen Deutschland, Österreich und der Schweiz handelt die Baader Bank über 800.000 Finanzinstrumente.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Latest Blogs

» Wiener Börse zu Mittag stärker: RBI, Bawag, Frequentis gesucht, DAX-Blic...

» ABC Audio Business Chart #101: Die verborgene 13-Billionen-Welt der Priv...

» Börsenradio Live-Blick 23/4: Gold runter, DAX fester und zeitweise über ...

» Börse-Inputs auf Spotify zu u.a. Bayer, Beiersdorf, SAP, AT&S, Amag, Varta

» ATX-Trends: AT&S, RBI, Addiko, UBM, S Immo, Strabag, Erste Group ....

» BSN Spitout Wiener Börse: Oberbank zurück über dem MA200

» Österreich-Depots: Stabil (Depot Kommentar)

» Börsegeschichte 22.4.: Mayr-Melnhof, S Immo, CA Immo (Börse Geschichte) ...

» Strabag kauft zu, US-Auftrag für Kapsch TrafficCom, Auszeichnungen für A...

» Nachlese: Societe Generale, Lisa Reichkendler, Yvonne Heil (Christian Dr...

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A39G83 | |

| AT0000A2C5J0 | |

| AT0000A39UT1 |

- Wiener Börse zu Mittag stärker: RBI, Bawag, Frequ...

- ABC Audio Business Chart #101: Die verborgene 13-...

- Vormittags-Mover: European Lithium, Ahlers, Klond...

- Unser Robot findet: Beiersdorf, Commerzbank, E.On...

- Erste Group finanziert Windpark in Rumänien

- Post: MitarbeiterInnen erhalten 6,45 Prozent mehr...

Featured Partner Video

Wiener Börse Party #626: Bawag macht es RBI nach, damit nähert sich der ATX TR seinem All-time-High, Addiko Bank unklar

Die Wiener Börse Party ist ein Podcastprojekt für Audio-CD.at von Christian Drastil Comm.. Unter dem Motto „Market & Me“ berichtet Christian Drastil über das Tagesgeschehen an der Wiener Börse....

Books josefchladek.com

I’ll Bet the Devil My Head

2023

Void

Inside

2024

Muga / Ediciones Posibles

India

2019

teNeues Verlag GmbH

Martin Frey & Philipp Graf

Martin Frey & Philipp Graf Cristina de Middel

Cristina de Middel Sebastián Bruno

Sebastián Bruno Igor Chekachkov

Igor Chekachkov Andreas Gehrke

Andreas Gehrke Helen Levitt

Helen Levitt