UNIQA Insurance Group AG / 2018: more premiums, increased earnings and higher dividends

21.02.2019, 8982 Zeichen

Corporate news transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

Annual Result

Vienna - UNIQA 2018: more premiums, increased earnings and higher dividends

+ Recurring premiums written rise by 3.1 per cent to EUR5,197 million + Total group premiums written rise slightly to EUR5,309 million + Combined ratio improves further to 96.8 per cent + Consolidated net profit rises by more than EUR70 million to EUR243 million + SCR capital requirement of around 250 per cent at high level in international comparison + Dividend to be increased for the seventh time in a row - from 51 cents to 53 cents + Slight growth is expected again in 2019 + Dividends also expected to increase in 2019

UNIQA CEO Andreas Brandstetter on the preliminary annual results: "2018 was a solid year for us in several respects. We expanded and obtained new customers in the 18 countries in which we operate. We further improved our combined ratio to 96.8 per cent, due to comparatively low expenses for weather damage among other reasons and increased consolidated net profit by more than EUR70 million to EUR243 million. Based on this expected result and our capital requirement that is at a strong international level of more than 250 per cent, we are able to propose the seventh dividend increase in a row of 53 cents."

Preliminary Key Group figures for 2018 in detail

Total premiums written by the UNIQA Group (including the savings portion of unit- and index-linked life insurance) rose slightly in 2018 by 0.3 per cent to EUR5,309.5 million (2017: EUR5,293.3 million). The solid growth in property and casualty insurance and health insurance compensated for the decline in life insurance premiums caused by the planned decrease in single premiums in international business. Recurring premiums included in total premiums written increased by 3.1 per cent to EUR5,196.7 million (2017: EUR5,039.3 million). Retained premiums earned (in accordance with IFRS) increased by 2.9 per cent to EUR4,760.7 million (2017: EUR4,627.9 million). Premiums written in property and casualty insurance climbed significantly by 5.1 per cent in Austria and in CEE to EUR2,774.4 million (2017: EUR2,639.7 million). Premiums written in health insurance rose by 4.3 per cent to EUR1,086.4 million (2017: EUR1,042.0 million). In life insurance, total premiums written including the savings portion of unit- and index-linked life insurance - driven by the strategic reduction of less-profitable single premiums in international business - declined by 10.1 per cent to EUR1,448.6 million (2017: EUR1,611.6 million).

In international business, premiums written in property and casualty insurance climbed by 7.0 per cent (2018: EUR1,067.4 million / 2017: EUR997.3 million) and those in health insurance by 23.5 per cent (2018: EUR77.6 million / 2017: EUR62.8 million), while life insurance premiums written fell by 23.5 per cent (2018: EUR419.7 million / 2017: EUR548.4 million) due to the planned decrease in single premiums, especially in Poland. In summary, UNIQA generated written premiums in international business including savings portions of EUR1,564.6 million (-2.7 per cent / 2017: EUR1,608.5 million), recurring premiums included in this rose by 7.0 per cent to EUR1,479.0 million (2017: EUR1,382.1 million).

In Austria as well, UNIQA recorded a significant increase in property and casualty premiums of 5.0 per cent to EUR1,703.5 million in 2018 (2017: EUR1,621.8 million), while health insurance premiums moved up by 3.0 per cent to EUR1,008.9 million in 2018 (2017: EUR979.7 million).

Premiums written in life insurance fell by 3.1 per cent to EUR1,022.0 million (2017: EUR1,055.2 million). In total, UNIQA generated growth in premiums written in Austria including savings portions of 2.1 per cent to EUR3,734.4 million (2017: EUR3,656.6 million). Recurring premiums included in that expanded by a pleasing 2.2 per cent to EUR3,707.4 million (2017: EUR3,629.0 million).

The total amount of retained insurance benefits of the UNIQA Group rose by 2.2 per cent to EUR3,626.6 million in 2018 (2017: EUR3,547.4 million). Benefits therefore grew slower than the corresponding retained premiums earned (+2.9 per cent).

Total consolidated operating expenses less reinsurance commissions received rose by 3.0 per cent to EUR1,314.7 million in 2018 (2017: EUR1,276.0 million). Despite the higher premiums earned, expenses for acquisitions fell by 0.4 per cent to EUR851.9 million (2017: EUR855.7 million). Due to higher costs for personnel and IT, other operating expenses (administration costs) increased by 10.1 per cent to EUR462.7 million in 2018 (2017: EUR420.3 million). This includes costs in connection with the innovation and investment programme amounting to EUR43 million.

The total cost ratio - the ratio of total operating expenses to premiums earned including the net savings portion of the premiums from unit- and index-linked life insurance - increased to 25.9 per cent (2017: 25.0 per cent). The combined ratio after reinsurance decreased to 96.8 per cent (2017: 97.5 per cent) due to the relatively low expenses for weather damage and the improved cost situation in property and casualty insurance.

Investment income rose by 1.6 per cent in 2018 to EUR581.2 million (2017: EUR572.1 million). The main reason for this increase was the sale of the indirect interest in Casinos Austria Aktiengesellschaft, which generated gains on disposal of EUR47.4 million for the UNIQA Group in 2018. The investment portfolio of the UNIQA Group (including investment property, financial assets accounted for using the equity method and other investments) decreased as at 31 December 2018 compared with the end of the previous year to EUR19,337.1 million (31 December 2017: EUR25,059.2 million).

The technical result of the UNIQA Group increased significantly by 26.7 per cent in 2018 to EUR140.2 million in 2018 (2017: EUR110.6 million). Operating result increased by 8.5 per cent to EUR350.1 million (2017: EUR322.7 million). Earnings before taxes of the UNIQA Group rose by 11.3 per cent to EUR294.6 million (2017: EUR264.6 million). Net profit for the period increased by 27.5 per cent to EUR235.1 million (2017: EUR184.4 million). Income tax expenses increased to EUR59.5 million (2017: EUR47.2 million). The tax rate was therefore 20.2 per cent (2017: 17.8 per cent).

Consolidated net profit (net profit for the period attributable to the shareholders of UNIQA Insurance Group AG) increased by more than EUR70 million or 41.6 per cent to EUR243.3 million (2017: EUR171.8 million). As a result earnings per share increased to EUR0.79 (2017: EUR0.56).

As at 31 December 2018, equity attributable to the shareholders of UNIQA Insurance Group AG decreased to EUR2,972.1 million (31 December 2017: EUR3,158.0 million). The return on equity in the year under review increased to 7.9% (2017: 5.4%).

In 2018, the average number of employees (full-time equivalents) at the UNIQA Group fell slightly to 12,818 (2017: 12,839) with the number of employees in Austria increasing from 5,987 to 6,058.

Note All the figures for the 2018 financial year are based on unaudited preliminary data. The final consolidated annual report for 2018 will be published at the same time as the Sustainability Report and the Economic Capital Report on the Group website www.uniqagroup.com http://www.uniqagroup.com/on 10 April 2019.

The figures for 2017 are subject to IAS 8 adjustments and therefore differ from the published figures.

Outlook

For the 2019 financial year, UNIQA is expecting growth in property and casualty premiums of approximately 2 per cent and a rise in premiums in health insurance of around 3 per cent. In contrast, a continuation of declining premiums in life insurance is expected. In 2019 as a whole, UNIQA is expecting a slight increase in total premium volume. UNIQA is also targeting a further improvement in its combined ratio in 2019. Earnings before taxes for 2019 are expected to be above 2018 figure after the adjustment for the non-recurring effect from the sale of the interest in Casinos Austria. In line with the progressive dividend policy, UNIQA intends to further increase the distribution per share for 2019 as well.

Forward-looking statements This press release contains statements concerning UNIQA's future development. These statements present estimates that were reached on the basis of all of the information available to us at the present time. If the assumptions on which they are based do not occur, the actual results may deviate from the results currently expected. As a result, no liability is accepted for this information.

end of announcement euro adhoc

issuer: UNIQA Insurance Group AG Untere Donaustraße 21 A-1029 Wien phone: 01/211 75-0 FAX: mail: investor.relations@uniqa.at WWW: http://www.uniqagroup.com ISIN: AT0000821103 indexes: ATX, WBI stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/220/aom

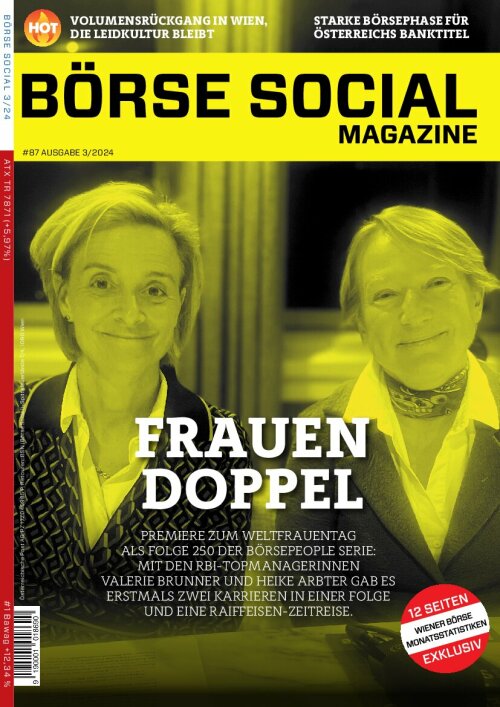

Wiener Börse Party #655: Skin in the game statt belächelter Finanzbildungsstrategie, warum kämpft Österreich solo gegen Aktien?

Uniqa

Uhrzeit: 22:58:08

Veränderung zu letztem SK: 0.30%

Letzter SK: 8.22 ( -0.96%)

Bildnachweis

1.

Uniqa auf der Gewinn Messe

>> Öffnen auf photaq.com

Aktien auf dem Radar:Marinomed Biotech, Österreichische Post, Zumtobel, Flughafen Wien, Austriacard Holdings AG, Frequentis, VIG, Verbund, Semperit, Cleen Energy, Gurktaler AG Stamm, Oberbank AG Stamm, OMV, Pierer Mobility, SW Umwelttechnik, Wolford, S Immo, Agrana, Amag, CA Immo, Erste Group, EVN, Immofinanz, Kapsch TrafficCom, Telekom Austria, Uniqa, Wienerberger, Warimpex, RHI Magnesita.

Random Partner

OeKB

Seit 1946 stärkt die OeKB Gruppe den Standort Österreich mit zahlreichen Services für kleine, mittlere und große Unternehmen sowie die Republik Österreich und hält dabei eine besondere Stellung als zentrale Finanzdienstleisterin.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A2K9L8 | |

| AT0000A2UVV6 | |

| AT0000A3BQ27 |

- BSN Spitout Wiener Börse: A1 Telekom Austria dreh...

- Erste Group: Ab 28. Mai werden Aktien zurückgekauft

- Wiener Börse: ATX am Mittwoch etwas schwächer, Ve...

- Wiener Börse Nebenwerte-Blick: RHI Magnesita, SW ...

- Erste Group: Dividende von 2,7 Euro je Aktie wird...

- CA Immo: Analysten bestätigen Accumulate-Rating n...

Featured Partner Video

Girostart und US-Dauerbrenner

Das Sporttagebuch mit Michael Knöppel - 4. Mai 2024 E-Mail: sporttagebuch.michael@gmail.com Instagram: @das_sporttagebuch Twitter: @Sporttagebuch_

Das Sporttagebuch mit Michael Knöppel - 4. Mai...

Books josefchladek.com

Körpersplitter

1980

Veralg Droschl

erotiCANA

2023

in)(between gallery

Flughafen Berlin-Tegel

2023

Drittel Books

The Burial Dress

2022

Self published

Berlin. Symphonie einer Weltstadt

1959

Ernst Staneck Verlag

Christian Reister

Christian Reister Sebastián Bruno

Sebastián Bruno Jerker Andersson

Jerker Andersson