EANS-General Meeting: voestalpine AG / Invitation to the General Meeting according to art. 107 para. 3 Companies Act

05.06.2019, 22276 Zeichen

General meeting information transmitted by euro adhoc with the aim of a Europe-wide distribution. The issuer is responsible for the content of this announcement.

05.06.2019

The German version of this invitation shall be binding. This English translation is for information purposes only.

voestalpine AG Linz FN 66209 t, ISIN AT0000937503

Invitation to the Annual General Meeting

We hereby invite our shareholders to the 27th Annual General Meeting of voestalpine AG taking place on Wednesday, July 3, 2019 at 10:00 a.m. in the Design Center Linz, Europaplatz 1, A-4020 Linz.

I. AGENDA

1. Presentation of the approved annual financial statements and management report, the proposal with respect to the distribution of profits, the consolidated financial statements and group management report, the consolidated corporate governance report and the report of the Supervisory Board to the Annual General Meeting on business year 2018/2019 and the Consolidated Non-Financial Report 2018 2. Resolution on the allocation of the balance sheet profit of the business year 2018/2019 3. Resolution on the discharge of the members of the Management Board for business year 2018/2019 4. Resolution on the discharge of the members of the Supervisory Board for business year 2018/2019 5. Resolution on the election of the auditor for the annual financial statements and group´s consolidated financial statements for business year 2019/2020 6. Re-election of the Supervisory Board 7. Resolution on the authorization of the Management Board of voestalpine AG a) to purchase own shares in accordance with Sec. 65 para. 1 no. 4 and no. 8 as well as para. 1a and para 1b of the Austrian Stock Corporation Act ("Aktiengesetz or AktG") both on the stock exchange and over-the-counter to the maximum extent of a total of 10% of the share capital also by excluding pro rata disposal rights which may accompany such an acquisition (reverse exclusion of subscription rights), b) in accordance with Sec. 65 para. 1b AktG to determine a method of selling or using shares in a manner other than via the stock exchange or a public offer based on the provisions on the exclusion of shareholders´ subscription rights, c) to decrease the share capital of the Company by a redemption of own shares without any further resolution by the Annual General Meeting, d) revocation of the authorization given by the Annual General Meeting on July 5, 2017. 8. Resolution on the creation of new authorized capital in an amount equal to 20% of the share capital against cash contributions and with statutory pre- emption rights, including indirect pre-emption rights as provided for in Sec. 153 para. 6 of the AktG [Authorized Capital 2019/I], and on corresponding amendments to Sec. 4 (Share Capital and Shares) para. 2 of the Articles of Association 9. Resolution on the creation of new authorized capital in an amount equal to 10% of the share capital for issue against contributions in kind and/or to employees, executives and members of the Management Board of the Company or companies affiliated with the Company including authorization to exclude pre-emption rights [Authorized Capital 2019/II], and on corresponding amendments to Sec. 4 (Share Capital and Shares) para. 2 of the Articles of Association 10. Resolution on authorization of the Management Board to issue financial instruments within the meaning of Sec. 174 of the AktG, in particular convertible bonds, income bonds and participation rights that can also convey subscription and/or conversion rights to acquire shares of the Company, including authorization to exclude shareholder pre-emption rights to acquire the financial instruments 11. Resolution on cancellation of the contingent capital in accordance with Sec. 159 para. 2 no. 1 AktG that was approved by a General Meeting resolution of July 2, 2014, on approval of a contingent increase in the share capital of the Company in accordance with Sec. 159 para. 2 no. 1 AktG in an amount equal to 10% of the share capital that can be used to issue shares to financial instrument holders [Contingent Capital 2019], and on corresponding amendments to Sec. 4 (Share Capital and Shares) para. 6 of the Articles of Association

II. DOCUMENTS FOR THE ANNUAL GENERAL MEETING; AVAILABILITY OF INFORMATION ON THE COMPANY WEBSITE In particular, the following documents will be available on the website of the Company at www.voestalpine.com [http://www.voestalpine.com/] no later than June 12, 2019:

Annual financial statements and management report,\nConsolidated corporate governance report,\nConsolidated Non-Financial Report 2018\nConsolidated financial statements and group management report,\nProposal with respect to the distribution of profits,\nReport of the Supervisory Board, in each case for business year 2018/2019,\nResolution proposals for agenda items 2-11,\nReport by the Management Board in accordance with Sec. 65 para. 1b in combination with Sec. 170 para. 2 and Sec. 153 para. 4 AktG with regard to agenda item 7,\nReport by the Management Board in accordance with Sec. 170 para. 2 of the AktG in combination with Sec. 153 para. 4 of the AktG with regard to agenda item 9,\nReport by the Management Board in accordance with Sec. 174 para. 4 of the AktG in combination with Sec. 153 para. 4 of the AktG with regard to agenda items 10 and 11,\nArticles of Association with proposed amendments in track changes mode,\nStatements pursuant to Sec. 87 para 2 AktG together with Curriculum vitae of the candidates for the elections to the Supervisory Board,\nProxy authorization forms,\nProxy cancellation form,\nComplete text of this invitation.\nIII. RECORD DATE AND PREREQUISITES FOR PARTICIPATING IN THE ANNUAL GENERAL MEETING

Eligibility to participate in the Annual General Meeting and to exercise voting rights and other shareholder rights that apply to the Annual General Meeting are based on the shareholding at the end of day on June 23, 2019 (record date to provide proof of shareholding). A person is only eligible to participate in the Annual General Meeting, if he/ she is a shareholder on this record date and is able to supply sufficient proof of this status to the Company. Proof of share ownership on the record date must be provided by delivering a deposit certificate in accordance with Sec. 10a of the AktG to the Company no later than June 28, 2019 (12:00 midnight, CEST, local Vienna time) exclusively via one of the following communication channels and addresses.

(i) for transmission of the deposit certificate in written form By mail or messenger voestalpine AG Legal, M&A and Compliance Attn. Mr. Christian Kaufmann voestalpine-Strasse 1 4020 Linz By SWIFT: GIBAATWGGMS - (Message Type MT598 or MT599; ISIN AT0000937503 must be indicated in the text) (ii) for transmission of the deposit certificate in text form, which is permitted under Sec. 19 para. 3 of the Articles of Association By fax +43 (0)1 8900 500 57 By e-mail anmeldung.voestalpine@hauptversammlung.at (Please use PDF format for deposit certificates)

Shareholders are requested to contact their depositary bank and arrange for the issuance and transmission of a deposit confirmation. The record date has no impact on the saleability of the shares and has no bearing on dividend rights.

Deposit certificates in accordance with Section 10a of the AktG The deposit certification must be issued by a depositary bank domiciled in a member state of the European Economic Area or a full member state of the OECD and must contain the following information:

Information on the issuer: company name and address or a code commonly used in dealings between banks,\nInformation on the shareholder: name/company name and address, in addition date of birth for natural persons, and register and register number, if applicable, for legal persons in the legal person's country of origin\nInformation on the shares: number of shares held by the shareholder, ISIN AT0000937503,\nSecurities account number and/or other designation,\nDate to which the deposit certificate refers.\n The depository certification to verify the shareholding as the basis for participation in the Annual General Meeting must relate to the above-mentioned record date for the proof of shareholding, i.e. June 23, 2019 (12:00 midnight, CEST, local Vienna time).

The deposit certificate will be accepted in German or English. For identification purposes, shareholders and their proxies are asked to be ready to show official photo identification when registering for the Annual General Meeting. In order to avoid delays at the entrance checks, shareholders are asked to present themselves in due time before the start of the Annual General Meeting. Voting cards may be collected starting at 9:00 a.m.

Data protection The processing of personal data by voestalpine AG is absolutely necessary for participation in the Annual General Meeting. Information on the processing of personal Data of participants of the Annual General Meeting in accordance with the General Data Protection Regulation is available at www.voestalpine.com/ datenschutz-hv [http://www.voestalpine.com/datenschutz-hv]

IV. POSSIBILITY TO APPOINT A PROXY AND THE PROCEDURE TO BE FOLLOWED

Every shareholder who is entitled to participate in the Annual General Meeting and has provided sufficient proof to the Company as described in point III of this invitation is also entitled to appoint a representative, who will participate in the Annual General Meeting on behalf of the shareholder and who is vested with the same rights as the shareholder who he or she represents. Proxy authorization must be granted to a specific person (natural person or legal entity) in text form (Sec. 13 para. 2 AktG). It is also possible to appoint several proxy holders. The proxy can be appointed before or during the Annual General Meeting. We offer the following communication channels and addresses for the delivery of proxies:

By mail or messenger voestalpine AG Legal, M&A and Compliance Attn. Mr. Christian Kaufmann voestalpine-Strasse 1 4020 Linz By fax +43 (0)1 8900 500 57 By e-mail anmeldung.voestalpine@hauptversammlung.at (Please use PDF format for deposit certificates)

The proxies must be received by the Company no later than July 2, 2019 at 4:00 p.m. (CEST, local Vienna time), exclusively at one of the previously listed addresses, unless they are submitted at the entry or exits check at the Annual General Meeting on the day of the Annual General Meeting. A form for the appointment (or revocation) of a proxy holder can be downloaded from the Company's Website at www.voestalpine.com [http://www.voestalpine.com/]. In order to ensure problem-free processing, we request that you only use the forms which have been made available. Details on appointing a proxy, especially the text form and contents of the proxy, are set out in the proxy authorization form made available to shareholders. If the shareholder has appointed the depositary bank (Sec. 10a AktG) as her or his proxy, it will suffice if the depositary bank submits a declaration in addition to the deposit certificate, via the communication channels stipulated for this purpose, stating that the depositary bank was appointed to serve as the proxy. Even after appointing a proxy, shareholders may still personally attend the Annual General Meeting and exercise their shareholder rights. Personal attendance is considered to serve as a revocation of the proxy authorization. The rules indicated above with respect to proxy authorization apply similarly to proxy cancellation.

Independent voting representative As a special service, a representative from the "Interessenverband für Anleger" (IVA, Austrian Association of Investors), Feldmühlgasse 22, 1130 Vienna, is available to shareholders as an independent voting proxy for exercising voting rights in accordance with shareholder instructions at the Annual General Meeting. IVA is currently planning to send Mr. Wilhelm Rasinger to represent shareholders at this Annual General Meeting. A special proxy form for authorizing Mr. Wilhelm Rasinger may be downloaded from the Company's website at www.voestalpine.com [http://www.voestalpine.com/] and must be delivered to the Company only to one of the addresses indicated above for delivery of proxy authorizations. Shareholders may also contact Mr. Wilhelm Rasinger directly at IVA by phone +43 (0)1 8763343 30, fax +43 (0)1 8763343 39, or via e-mail at wilhelm.rasinger@iva.or.at. Shareholder must provide Mr. Wilhelm Rasinger with instructions on how he (or a sub-proxy authorized by Mr. Wilhelm Rasinger) is to exercise their voting rights. Mr. Wilhelm Rasinger only exercises voting rights based on the instructions given by the shareholder. Without explicit instructions, Mr. Wilhelm Rasinger will not exercise voting rights based on the proxy authorization.

Guests The General Meeting is the key governing body of a stock corporation as it is the forum for the Company's owners - the shareholders. We therefore hope you will appreciate that we cannot turn a General Meeting into an event for guests, much as we value such interest. For further questions please contact the Investor Relations Team (phone: +43 (0) 50304 15 8735, e-mail: IR@voestalpine.com)

V. INFORMATION ON THE RIGHTS OF SHAREHOLDERS AS DEFINED IN SECTIONS 109, 110, 118 AND 119 AUSTRIAN STOCK CORPORATION ACT (AKTG)

1. Additions to the agenda pursuant to Sec. 109 AktG Shareholders whose combined holdings represent at least 5% of the share capital and who have owned these shares for at least three months prior to making such request have the right to request in writing that additional items be put on the agenda of this Annual General Meeting and be published provided that such request is made in writing and delivered to the Company no later than June 12, 2019 (12:00 midnight, CEST, local Vienna time) only to the address voestalpine-Strasse 1, 4020 Linz, Legal, M&A and Compliance, Attn. Mr. Christian Kaufmann. Each agenda item requested must be accompanied by a resolution proposal and a statement of reasons. Proof of shareholder status must be provided by submitting a deposit certificates in accordance with Sec. 10a of the AktG that confirms that the requesting shareholders have owned the shares for at least three months before the request and must no more than seven days old at the time it is submitted to the Company. Please refer to the section on the right to attend the Annual General Meeting for information on the other requirements for the deposit certificate (point III). 2. Resolutions proposed for the agenda by shareholders pursuant to Sec. 110 AktG Shareholders whose combined holdings represent at least 1% of the share capital have the right to submit resolution proposals in text form for any agenda item, together with a statement of reasons, and request that these proposals, together with the names of the shareholders concerned, the reasons given and any statement by the Management Board or Supervisory Board, be made available on the Company's website as entered into the Commercial Register. Such requests must be delivered to the Company in text form no later than June 24, 2019 (12:00 midnight, CEST, local Vienna time) either by fax to +43 (0) 50304 15 5872 or by mail to the address voestalpine-Strasse 1, 4020 Linz, Legal, M&A and Compliance, Attn. Mr. Christian Kaufmann, or by e-mail to christian.kaufmann@voestalpine.com, whereby the written request must be attached to the e-mail, e.g. as a PDF file. The following should be noted regarding elections to the Supervisory Board (agenda item 6): In nominations for the election of a Supervisory Board member, the justification statement shall be replaced with a declaration by the person being nominated in accordance with Sec. 87 para. 2 AktG. These declarations must be received by the Company no later than June 24, 2019, and the Company must make them available on the Company website recorded in the Commercial Register no later than June 26, 2019. Otherwise, the respective person may not be included in the voting. In electing Supervisory Board members, the Annual General Meeting must consider the criteria set forth in Sec. 87 para. 2a AktG, particularly the professional and personal qualifications of the members, the professional balance of the Supervisory Board, aspects of diversity and internationalism as well as professional reliability. It is further announced, with respect to nominations for the election of Supervisory Board members, that the Company is subject to the application of Sec. 86 para. 7 AktG regarding proportional gender equality on the Supervisory Board, and therefore the minimum share requirement of Sec. 86 para. 7 AktG must be taken into account. Neither a majority of the shareholder representatives nor a majority of the employee representatives raised an objection under Sec. 86 para. 9 AktG to full compliance with the quota. Therefore, if the number of Supervisory Board members remains the same, full compliance with the minimum share requirement means that four women must be on the Supervisory Board of the Company in the future. Proof of shareholder status must be provided by submitting a deposit certificate in accordance with Sec. 10a of the AktG that is no more than seven days old at the time it is submitted to the Company. Please refer to the section on the right to attend the Annual General Meeting for information on the other requirements for the deposit certificate (point III). 3. The right of shareholders to obtain information pursuant to Sec. 118 AktG Every shareholder has the right to request information on any matters pertaining to the Company provided that such information is needed to properly evaluate an agenda item. This obligation to provide information also covers the Company's legal relations with an associated company as well as the status of the Group and companies included in the consolidated financial statements. Information may be denied if, based on the assessment of a prudent businessman, it could cause significant detriments to the Company or an affiliated company, or if provision of the information would be punishable. In accordance with Sec. 20 para. 3 of the Articles of Association, the chairperson of the Annual General Meeting may set appropriate limits for the time allotted to speakers and the time allotted for questions as well as general limitations for speaking time and time for posing questions during the Annual General Meeting. Requests for information at the Annual General Meeting are generally to be made orally, but may also be submitted in written form. To make efficient use of time during the Annual General Meeting, questions whose answers require lengthy preparation should be submitted in text form to the Management Board in timely fashion before the Annual General Meeting. Such questions should be submitted to the company to the address voestalpine-Strasse 1, 4020 Linz, Investor Relations Department, Attn. Mr. Peter Fleischer or by e-mail to IR@voestalpine.com or by fax to +43 (0) 50304 55 5581. 4. Motions by Shareholders at the Annual General Meeting pursuant to Sec. 119 AktG Regardless of the number of shares held, every shareholder has the right to make motions on any agenda item during the Annual General Meeting. If several motions have been proposed for one item on the agenda, the Chairman of the Annual General Meeting determines the order of voting pursuant to Sec. 119 para. 3 AktG. Regarding nominations of candidates for election to the Supervisory Board, the relevant comments under Item V - Resolutions proposed for the agenda by shareholders pursuant to Sec. 110 AktG must be observed. 5. Information on the website Additional information on these shareholder rights, which are provided for in Sec. 109, 110, 118 and 119 AktG, is available on the Company's website www.voestalpine.com [http://www.voestalpine.com/].

VI. FURTHER DICSLOSURES AND INFORMATION

1. Total number of shares On the date the Annual General Meeting was convened, the Company had share capital of EUR 324,391,840.99 divided into 178,549,163 no-par bearer shares. Each share grants one vote. On the date the Annual General Meeting was convened, the Company held 28,597 treasury shares that do not confer any rights. 8,975 shares were declared invalid in accordance with Sec. 67 para. 2 in combination with Sec. 262 para. 29 AktG whereof 1,752 shares have not been submitted and credited to securities accounts on the date the Annual General Meeting was convened. Therefore, on the date the Annual General Meeting was convened there were a total of 178,518,814 shares giving their owners the right to attend and vote at the Annual General Meeting. There are no other classes of shares. 2. Internet broadcast of part of the Annual General Meeting It is planned to transmit a webcast of the Annual General Meeting up to the start of the general debate. Shareholders of the Company and the interested public may follow the speech by the Chairman of the Management Board at the Annual General Meeting on July 3, 2019 live on the Internet at www.voestalpine.com [http:// www.voestalpine.com/] starting at approx. 10:00 a.m. No video or audio broadcast of any other part of the Annual General Meeting will take place.

Linz, June 2019

The Management Board

end of announcement euro adhoc

issuer: voestalpine AG voestalpine-Straße 1 A-4020 Linz phone: +43 50304/15-9949 FAX: +43 50304/55-5581 mail: IR@voestalpine.com WWW: www.voestalpine.com ISIN: AT0000937503 indexes: WBI, ATX stockmarkets: Wien language: English

Digital press kit: http://www.ots.at/pressemappe/2054/aom

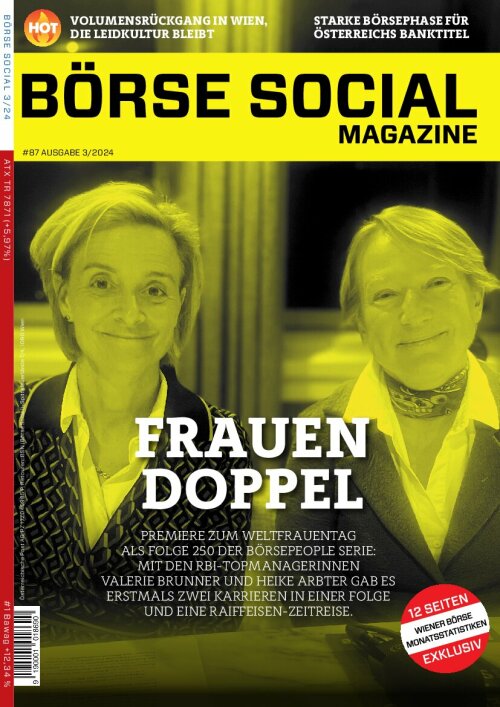

Börsepeople im Podcast S12/14: Nina Higatzberger-Schwarz

voestalpine

Uhrzeit: 10:12:38

Veränderung zu letztem SK: 0.31%

Letzter SK: 25.70 ( 2.31%)

Bildnachweis

1.

voestalpine: Formel E, Rennen, Race, Showcar, Credit: voestalpine

>> Öffnen auf photaq.com

Aktien auf dem Radar:Polytec Group, Palfinger, Immofinanz, Warimpex, Flughafen Wien, Austriacard Holdings AG, Rosgix, Verbund, RBI, Porr, Frequentis, Addiko Bank, AT&S, Cleen Energy, Gurktaler AG Stamm, SBO, SW Umwelttechnik, Oberbank AG Stamm, Marinomed Biotech, Agrana, Amag, CA Immo, Erste Group, EVN, FACC, Kapsch TrafficCom, OMV, Österreichische Post, Telekom Austria, Uniqa, VIG.

Random Partner

Knaus Tabbert

Die Knaus Tabbert AG ist ein führender Hersteller von Freizeitfahrzeugen in Europa mit Hauptsitz im niederbayerischen Jandelsbrunn. Weitere Standorte sind Mottgers, Hessen, Schlüsselfeld sowie Nagyoroszi in Ungarn. Das Unternehmen ist seit September 2020 im Segment Prime Standard der Frankfurter Wertpapierbörse notiert.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Mehr aktuelle OTS-Meldungen HIER

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten

| AT0000A36XA1 | |

| AT0000A2SUY6 | |

| AT0000A38J73 |

- DAX-Frühmover: DAIMLER TRUCK HLD..., Henkel, Infi...

- wikifolio Champion per ..: Jörn Remus mit Nordstern

- ATX TR-Frühmover: Mayr-Melnhof, Andritz, Bawag, L...

- AMAG sichert sich Grünstrom aus drei neuen Windkr...

- Wiener Börse: Handelsumsätze im April höher als i...

- Aurubis büßt stark ein (Peer Group Watch Deutsche...

Featured Partner Video

Börsepeople im Podcast S12/04: Harald Waiglein

Harald Waiglein ist im Finanzministerium zuständig für Wirtschaftspolitik und Finanzmärkte, früher zusätzlich für Zoll. International vertritt er Österreich als Verwaltungsratsvorsitzender der Euro...

Books josefchladek.com

Bolnichka (Владислава Краснощока

2023

Moksop

Inside

2024

Muga / Ediciones Posibles

Index Naturae

2023

Skinnerboox

Liebe in Saint Germain des Pres

1956

Rowohlt

Horst Pannwitz

Horst Pannwitz Andreas Gehrke

Andreas Gehrke Jerker Andersson

Jerker Andersson Christian Reister

Christian Reister Christian Reister

Christian Reister