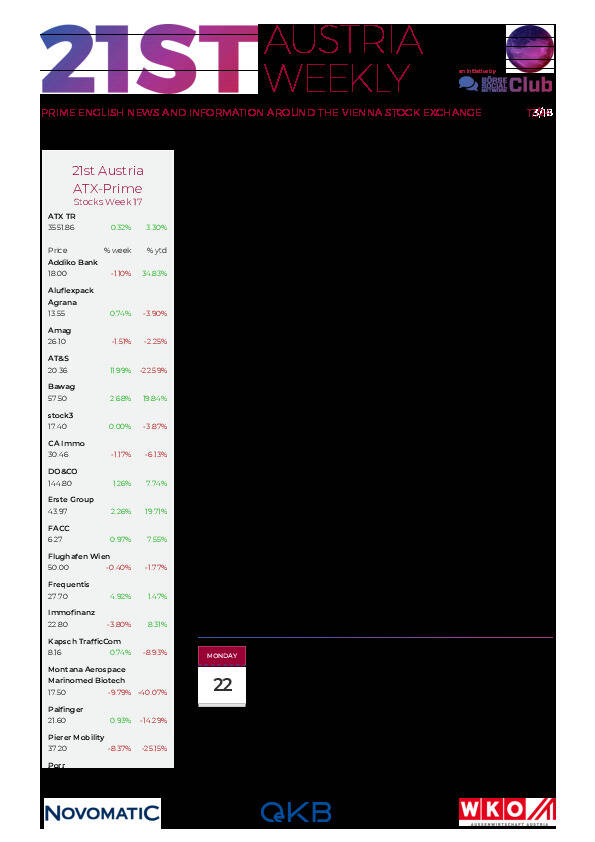

21st Austria weekly - Marinomed, UBM (11/04/2024)

14.04.2024, 1947 Zeichen

Marinomed: Marinomed Biotech AG announced the expansion of its Carragelose product portfolio with new launches in Austria and Mexico, paving the way for targeting new indications and access to key markets. A new nasal spray formulation for the treatment of the symptoms of hay fever caused by grass pollen allergy has been launched by Marinomed’s Austrian distribution partner Sigmapharm under the brand name COLDAMARIS Allergie. Offering both symptom prevention and relief of allergic symptoms such as dryness in the nasal cavity, runny or blocked nose, itching and sneezing, this market entry perfectly coincides with the peak of this year’s allergy season. The launch of the allergen-blocking nasal spray also represents an important landmark in the expansion of the established Carragelose portfolio from blocking viruses to allergic indications, providing year-round revenue generation beyond the typical cold season.

Marinomed Biotech: weekly performance:

UBM: UBM Development AG closed the 2023 financial year with negative earnings before tax of €39.4m. The loss resulted, above all, from revaluations of approximately €70m to projects and properties during the past year as well as the still difficult transaction market. “2023 will undoubtedly go down as an “annus horribilis“ in the history of the real estate market. In spite of this adverse operating climate, UBM has demonstrated its resilience and relative strength“ indicated Thomas G. Winkler, CEO of UBM Development AG. As of 31 December 2023, UBM held cash and cash equivalents of €151.5m and had an equity ratio of 30.3%. The outstanding €91.05m from the UBM bond 2018-2023 was repaid in full from internal cash reserves during the fourth quarter of 2023. It is also important to highlight that no other bond repayments will be due until November 2025.

UBM: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (11/04/2024)

Wiener Börse Party #640: Ultimo April-Handel, Sparplan-Boost bei der Erste Group, Poetry Slam für die Finanzbranche, VIG vs. Coba

Bildnachweis

Aktien auf dem Radar:Polytec Group, Immofinanz, Palfinger, Warimpex, Flughafen Wien, Austriacard Holdings AG, EVN, Rosgix, S Immo, Erste Group, Österreichische Post, Cleen Energy, Marinomed Biotech, Pierer Mobility, RBI, Addiko Bank, SW Umwelttechnik, Oberbank AG Stamm, Agrana, Amag, CA Immo, Kapsch TrafficCom, OMV, Telekom Austria, Uniqa, VIG, Wienerberger.

Random Partner

iMaps Capital

iMaps Capital ist ein Wertpapier- und Investmentunternehmen mit Schwerpunkt auf aktiv verwaltete Exchange Traded Instruments (ETI). iMaps, mit Sitz auf Malta und Cayman Islands, positioniert sich als Private Label Anbieter und fungiert als Service Provider für Asset Manager und Privatbanken, welche ETIs zur raschen und kosteneffizienten Emission eines börsegehandelten Investment Produktes nutzen wollen.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten