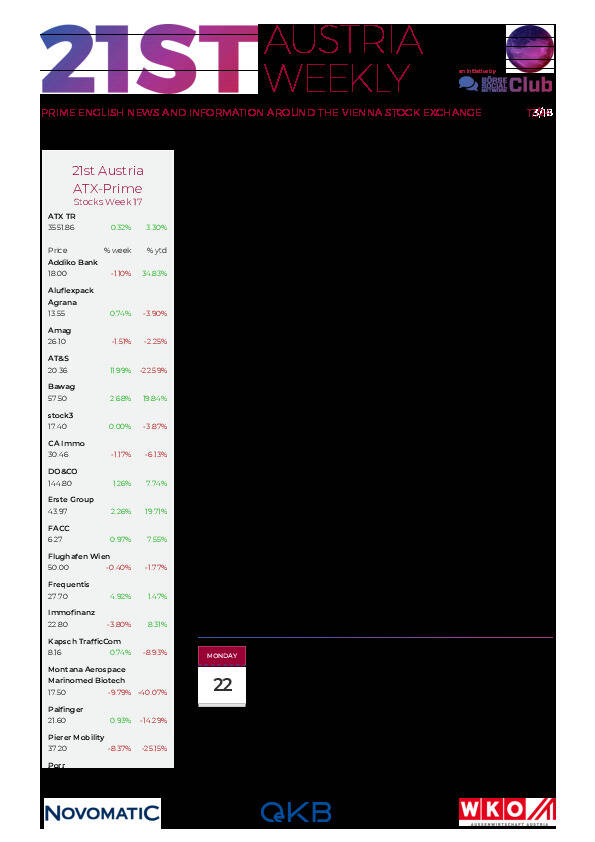

21st Austria weekly - Uniqa, Zumtobel (07/03/2024)

10.03.2024, 2201 Zeichen

Uniqa: UNIQA Insurance Group AG announced strong premium growth and increased earnings at the presentation of the preliminary 2023 financial results: premiums written increased by 9.7 per cent to €7,185.6 million, while earnings before taxes exceeded expectations at €426.4 million. Consolidated profit/(loss) (the proportion of net profit/(loss) for the period attributable to the shareholders of UNIQA Insurance Group AG) increased by 18 per cent to €302.7 million (2022: €256.0 million). Andreas Brandstetter, CEO UNIQA Insurance Group: “In the past year 2023, we made substantial payments for weather-related claims, mainly due to the storms in July and August. We were also affected by significant major claims. Nevertheless, 2023 was another successful financial year: We were once again able to grow noticeably as a Group and further increase our earnings. Our companies in the CEE region are developing particularly well and are making a substantial contribution to our increased profitability”.

Uniqa: weekly performance:

Zumtobel: The lighting group Zumtobel recorded a decline in sales of 7.9 percent to 840 million euros in the first nine months of the current financial year 2023/24. According to the company, the reason for this was the continued weak demand in the Components segment, although a slight recovery slowly emerged in the third quarter, as the company reports. The Components segment recorded a decline in sales of -20.4 percent to 222.6 million euros, while sales in the Lightning division fell by -2.1 percent to 663.4 million euros. Adjusted EBIT fell by 32.5 percent to EUR 45.9 million compared to the same period last year. This corresponds to an adjusted EBIT margin of 5.5 percent (previous year: 7.5 percent). The company's profit amounts to 21.4 million euros after 43.4 million euros in the previous year. The outlook has been confirmed: For the 2023/24 financial year, the company continues to expect a decline in sales in the mid-single-digit percentage range and an adjusted EBIT margin (excluding special items) of 4 to 6 percent.

Zumtobel: weekly performance:

(From the 21st Austria weekly https://www.boerse-social.com/21staustria (07/03/2024)

SportWoche Podcast #106: Persönliches Fail-Fazit VCM und Staatsmeisterin Carola Bendl-Tschiedel über Rekordlerin Julia Mayer

Bildnachweis

Aktien auf dem Radar:Immofinanz, Polytec Group, Marinomed Biotech, Flughafen Wien, Warimpex, Lenzing, AT&S, Strabag, Uniqa, Wienerberger, Pierer Mobility, ATX, ATX TR, VIG, Andritz, Erste Group, Semperit, Cleen Energy, Österreichische Post, Stadlauer Malzfabrik AG, Addiko Bank, Oberbank AG Stamm, Agrana, Amag, CA Immo, EVN, Kapsch TrafficCom, OMV, Telekom Austria, Siemens Energy, Intel.

Random Partner

Immofinanz

Die Immofinanz ist ein börsenotierter gewerblicher Immobilienkonzern, der seine Aktivitäten auf die Segmente Einzelhandel und Büro in sieben Kernmärkten in Europa (Österreich, Deutschland, Tschechien, Slowakei, Ungarn, Rumänien und Polen) fokussiert. Zum Kerngeschäft zählen die Bewirtschaftung und die Entwicklung von Immobilien.

>> Besuchen Sie 68 weitere Partner auf boerse-social.com/partner

Useletter

Die Useletter "Morning Xpresso" und "Evening Xtrakt" heben sich deutlich von den gängigen Newslettern ab.

Beispiele ansehen bzw. kostenfrei anmelden. Wichtige Börse-Infos garantiert.

Newsletter abonnieren

Runplugged

Infos über neue Financial Literacy Audio Files für die Runplugged App

(kostenfrei downloaden über http://runplugged.com/spreadit)

per Newsletter erhalten